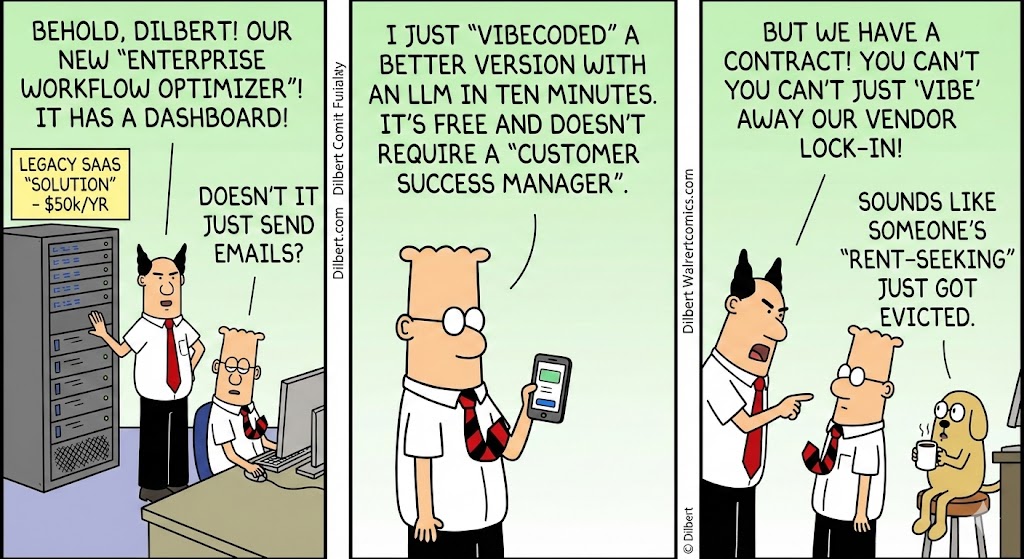

The Rent Is Too Damn High: How Vibecoding and The Outcome Economy Are Killing the SaaS Dinosaurs

Let’s start with a bedtime story that is currently keeping the General Counsel of a $10 billion company awake at night.

In June of this year (2025), a developer named Michael Luo (known online as “AzianMike”) decided he was tired of paying DocuSign $15 a month to sign three PDFs.1 He didn’t complain on X (formerly Twitter). He didn’t switch to a competitor.

He opened an IDE called Cursor, invoked a few AI agents (Claude 3.5 Sonnet, mostly), and “vibecoded” a tool called Inkless.

He didn’t write the code line-by-line. He didn’t hire a PM, a Designer, or a QA engineer. He just… vibed. He told the AI what he wanted: “Make me a drag-and-drop e-signature tool that sends a PDF to an email."

Two days later, Inkless was live. It was free. It worked perfectly.

DocuSign’s response was not to innovate. It was to panic. They sent Luo a Cease and Desist letter so aggressive it could have been written by a T-800. They claimed “intellectual property infringement” and “false and misleading statements.”

Why? Because Michael Luo hadn’t just built a clone. He had exposed the dirty, trillion-dollar secret of the SaaS industry: Most “Enterprise Software” is just a CRUD database with a Stripe subscription attached.

“The reality of building web apps in 2025 is that it’s a bit like assembling IKEA furniture. You don’t make the wood. You just put it together.” — Andrej Karpathy (Founding member, OpenAI)

DocuSign isn’t a tech company; it’s a landlord. And the tenants just figured out they can build their own house for the price of a sandwich.

The “Golden Age” of Rent-Seeking (2010–2024)

To understand the murder, you have to look at the victim. For the last 15 years, we lived in the Golden Age of SaaS. The business model was beautiful in its simplicity:

- Find a human friction point (Sales, HR, Inventory).

- Build a workflow wrapper around a database.

- Charge $50/user/month forever.

Investors loved it. We called it “Recurring Revenue.” It was predictable. It was safe. It minted billionaires. But it relied on a massive barrier to entry: Software was hard to build.

If you were a Digital Media Publisher, you couldn’t just “build” your own ad server or CRM. You had to buy Salesforce and Google Ad Manager. You were a hostage to their roadmap and their pricing.

The Content Publisher Who Walked Away

But that hostage situation is over. I recently witnessed the CTO of a mid-sized digital media publisher (let’s call them “DailyTech”) torch a $120,000/year contract that combined a legacy CRM and a complex Ad Server license.

For years, they paid this “AdTech Tax” because they believed the vendor’s hype that managing ad inventory required “proprietary algorithms” and “black box magic.” It didn’t.

Here is what happened:

The CTO took her 5 in-house engineers. They didn’t start a 12-month migration project. They spent three weeks “vibecoding.”

- The CRM: They prompted an AI to build a React front-end that mirrored exactly how their sales team booked campaigns. They stripped out the 50 unnecessary clicks the SaaS tool forced on them and built a streamlined interface that just did one thing: sold ads.

- The Ad Server: They used AI agents to write the ad-serving logic that connected directly to their content management system (CMS) and analytics.

- The Cost: A few thousand dollars in developer hours and API tokens.

The Result:

They now have a proprietary Ad Tech stack that fits their business like a glove. It is faster, it has zero license fees, and they own the IP. The SaaS vendor didn’t just lose a customer; they lost the ability to argue that their software was hard to build.

The “50 to 5” Engineering Shift

This aligns perfectly with what Sarah Guo, founder of Conviction VC, predicted:

“We are seeing a shift where clients are replacing 50-person engineering teams with 5-person ‘AI Architect’ teams. The bottleneck is no longer code; it is clarity of thought.”

Companies are no longer buying software; they are generating it. The “Make vs. Buy” calculation has flipped. “Make” used to be risky. Now, “Make” is instant, disposable, and perfectly customized.

The Economic Theory: Why Subscriptions Are Dead

This isn’t just a tech shift; it’s a macroeconomic correction. The SaaS model is built on Access Economics. You pay for access to the tool, usually via a “seat license.” But in an AI world, access to code is abundant.

Let’s look at the economic forces destroying the subscription model.

1. The Jevons Paradox of Code

Economists love the Jevons Paradox: As technology increases the efficiency with which a resource is used, the total consumption of that resource increases rather than decreases.

In software, this means: As the cost of writing code drops to zero, the amount of software in the world will explode.

We will have more software than ever before. But we will pay for less of it. We will have millions of “Disposable Apps”—software that exists for a single project, a single week, or a single day, and is then deleted. You don’t pay a monthly subscription for a disposable fork.

“If the cost of intelligence trends to zero, the value of ‘renting’ intelligence (SaaS) trends to zero. The value shifts to the outcome.” — Sam Altman (CEO, OpenAI)

2. The Death of Seat-Based Pricing

The subscription model assumes that value is tied to human headcount. The more people using the software, the more value you get. This is fundamentally broken in an AI world.

- Old World: You hire 10 SDRs. You buy 10 Salesforce licenses. Value = 10 humans working.

- New World: You hire 1 AI Sales Agent. It does the work of 100 SDRs. You buy 0 Salesforce licenses.

Why would a company pay for “seats” when the goal of AI is to reduce the number of seats needed? The economic incentive is now to eliminate the human user, which eliminates the SaaS revenue stream.

Porter’s Five Forces: The SaaS Massacre

If you apply Michael Porter’s famous strategy framework to a typical “Workflow SaaS” company (like a Project Management tool or a CRM) in 2025, it isn’t just a threat; it is an extinction-level event.

1. Threat of New Entrants (EXTREME)

- The Reality: The “Moat” of development cost has evaporated.

- The Impact: Two teenagers in a basement with an LLM can now replicate the core feature set of a $100M ARR company in a weekend. There is no longer a “minimum capital requirement” to start a software company. Every developer is a potential rival.

2. Threat of Substitutes (EXTREME)

- The Reality: The biggest competitor to Salesforce is no longer HubSpot; it is The Customer.

- The Impact: The “Make vs. Buy” decision has fundamentally shifted. When “Making” takes 3 days and costs $50, the substitute for buying SaaS is building a custom internal tool. The “Home Cooked Meal” is finally cheaper and better than the restaurant.

3. Bargaining Power of Buyers (INFINITE)

- The Reality: Vendor lock-in is dead.

- The Impact: Data portability is mandated by law (GDPR) and facilitated by AI agents that can map schemas instantly. If a SaaS vendor raises prices by 10%, the buyer can simply prompt an agent: “Export all my data from Asana, build me a clone in React, and import the data." Churn is no longer painful; it’s trivial.

4. Bargaining Power of Suppliers (HIGH)

- The Reality: SaaS companies are no longer the source of intelligence; they are resellers.

- The Impact: The “Suppliers” are the Foundation Model providers (OpenAI, Anthropic, Google). SaaS companies are just UI wrappers around these models. The suppliers hold all the leverage. If OpenAI raises API costs or releases a feature that eats your wrapper (like “Canvas”), you are dead. You are a middleman in a world that hates middlemen.

5. Rivalry Among Existing Competitors (CUTTHROAT)

- The Reality: Feature Commoditization.

- The Impact: When everyone uses the same AI models to generate code and features, differentiation drops to zero. If you launch a cool new “AI Summary” feature, your competitor will vibecode the same feature by Tuesday. This leads to a brutal price war, driving margins down to the cost of compute.

Industry Deep Dive: The AdTech “Survival Matrix”

Let’s apply this to AdTech, an industry notorious for bloating workflows and charging a “tax” on every dollar. Using the lens of Vibecoding vs. Agents, we can categorize the industry into two buckets: The Dead (Commodities) and The Living (Outcomes).

1. The Commodities (Ripe for Vibecoding)

These are tools that simply move data or format it. Clients will stop buying these and start building them.

- Reporting Dashboards (Datorama, Tableau):

- Why it dies: A dashboard is just a SQL query visualized. A Marketing Manager can now drop a CSV into a customized LLM and say, “Graph my ROAS by region.” They don’t need a $50k/year license for a tool that just shows them their own data.

- Tag Management Systems (GTM wrappers):

- Why it dies: It’s just JavaScript injection. An in-house engineer can vibecode a custom container script in 20 minutes that is lighter, faster, and free.

- Creative Resizing Tools:

- Why it dies: Tools that charge per-seat to crop images for different banner sizes are finished. This is a native feature of every generative AI model now. It’s a feature, not a company.

- Insertion Order (IO) Workflow Management:

- Why it dies: This is just “sending emails with PDFs.” (See: The DocuSign story).

2. The High-Value Outcomes (Ripe for Agency-as-a-Service)

These are tools that make decisions and generate revenue. Clients will pay a premium for these.

- The AI Media Trader (Replacing the DSP UI):

- The Pivot: Don’t sell me a Demand Side Platform (DSP) where I have to log in and adjust bids. Sell me an Agent that connects to the exchange, analyzes the bid stream in real-time, and buys the inventory that converts.

- The Model: I won’t pay a platform fee (%). I will pay a “Performance Fee” based on the ROAS lift you achieve.

- Dynamic Creative Optimization (DCO) Agents:

- The Pivot: Don’t sell me a tool to “manage” my banners. Sell me an Agent that generates 1,000 variations, tests them live, kills the losers, and scales the winners automatically.

- The Value: The value isn’t the tool; it’s the decision to swap the headline from “Buy Now” to “Shop Today.”

- Fraud Detection & Prevention:

- The Pivot: This is “Liability-as-a-Service.” I will pay you to ensure I don’t buy bot traffic. I am paying for the outcome of clean traffic, not the workflow of looking at logs.

The AdTech Lesson: If your product allows a human to do work, you are a commodity. If your product replaces the human to generate profit, you are an Agent.

The Psychology of Delegation (Why We Will Still Pay)

If vibecoding is so easy, why will anyone pay for software ever again? Why won’t every company just build everything themselves?

The answer lies in Behavioral Economics and the Psychology of Delegation. We will still pay, but we will pay for different reasons.

1. The “Cognitive Miser” Theory

Humans are evolutionarily wired to conserve energy. Decision-making burns calories.

- The Insight: Even if I can vibecode a travel booking app in 10 minutes, I don’t want to. I don’t want to maintain it. I don’t want to think about the APIs breaking.

- The Opportunity: We will pay for software that acts as a “Complexity Abstraction Layer." We pay not because we can’t do it, but because we are lazy. The software that survives will be the software that requires Zero Interaction.

2. Liability-as-a-Service (The “Blame” Market)

This is the darkest and most true aspect of corporate psychology. Managers buy software to mitigate risk.

- The Insight: If I build an internal HR tool and it accidentally deletes payroll data, I get fired. If I buy Workday and it deletes payroll data, Workday gets sued.

- The Opportunity: Companies like SAP, Oracle, and DocuSign might survive not because of their code, but because they sell Liability Insurance. You are paying for a throat to choke. You cannot sue a vibecoded script you wrote yourself.

3. The Principal-Agent Problem Solved

In traditional business, the “Principal” (You) hires an “Agent” (Employee/Software) to do a task. Usually, the incentives are misaligned (the employee wants to do the least work for the most pay).

- The Insight: In the Outcome Economy, AI Agents are the perfect employees. They have no ego, no fatigue, and total alignment with the prompt.

- The Opportunity: We will pay a premium for “Agentic Trust." We will pay for the software that has the best track record of not hallucinating. We aren’t paying for the workflow; we are paying for the reliability of the decision.

“The future of business is not about who has the best software. It’s about who has the best judgement. Software is cheap; judgement is expensive.” — Naval Ravikant

Conclusion: Evolve or Be Vibecoded

To the SaaS founders reading this: Stop selling forms. Stop selling “digital transformation.” Stop selling “efficiency.”

If your product requires a human to log in, stare at a screen, and click buttons to move data from Column A to Column B, you are a “FormWiz.” You are charging rent for a house that anyone can now build for free.

You must evolve into Agency-as-a-Service.

- Don’t sell me a tool to manage my ads. Sell me an agent that optimizes my ROAS.

- Don’t sell me a tool to write code. Sell me an agent that ships features.

As for DocuSign? They can send all the cease and desist letters they want. But they should remember what happened to the music industry when they tried to sue Napster. They didn’t stop digital music. They just made sure they weren’t the ones selling it.

Closing thought: The next billion-dollar software company won’t have 5,000 employees. It will have 10 employees and 50,000 agents. And they won’t be charging a subscription—they’ll be taking a cut of the profits.