Sherlock Economics: Why Your $20M AI Startup Is Just an Unpaid Internship for OpenAI

The “Oh S**t” Moment

I was sitting in Zus Coffee in Kuala Lumpur —or maybe it was a Third Wave Coffee in Bangalore or a Blue Bottle in San Francisco; the scent of venture capital desperation smells the same everywhere—listening to a pitch. The founder, let’s call him “Prompty Paul,” was sweating through his sustainable Allbirds.

“We are building the definitive interface for legal document analysis,” Paul said, his eyes gleaming with the manic energy of a man who just raised a seed round at a $20M valuation on a napkin. “We take a PDF, you ask questions, it answers. It’s a moat. A fortress. A revolution.”

I looked at him. He looked at me. Then I looked at my phone.

Ping.

Notification from OpenAI: “New Feature Alert: Upload any document, analyze instantly. Free for Plus users.”

I turned the screen to Paul. The color drained from his face faster than liquidity from a crypto exchange in 2022.

“That’s… that’s just a feature,” he stammered, his voice cracking. “We have… better prompt engineering. We have a dark mode.”

Paul didn’t have a company. Paul had a button. And that button just got “Sherlocked.”

As one anonymous VC brutally put it: “If you’re building a feature that a platform can add in a weekend, you’re not a founder. You’re an unpaid intern for Satya Nadella."

This isn’t just about Paul. This is about the brutal, hilarious, and terrifying economic reality of 2025. Welcome to the Kill Zone.

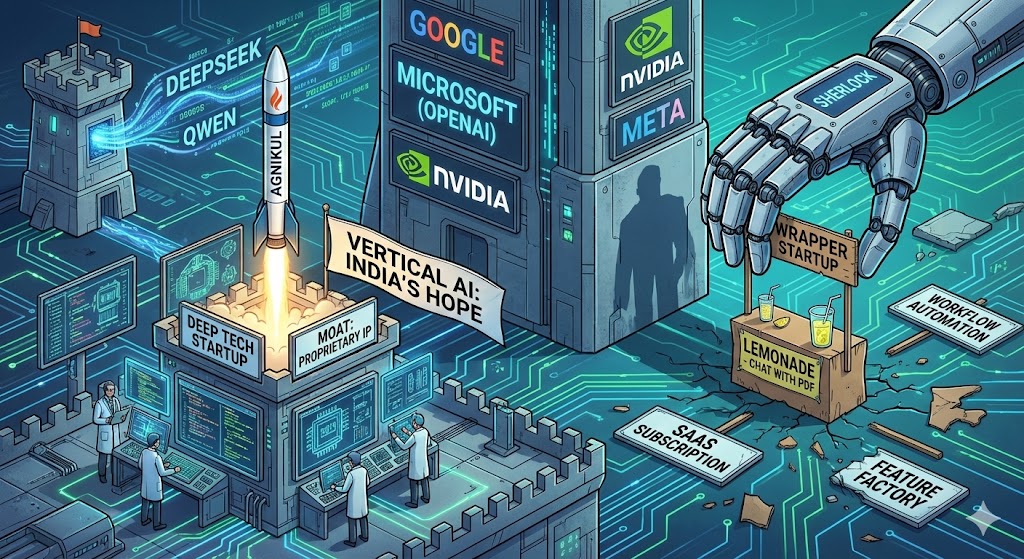

The Macro “Vibes”: A Tale of Four Empires

Before we dance on the grave of Paul’s startup, let’s zoom out. The global economic chessboard has shifted. It’s no longer a “Global Village”; it’s “Global Fight Club,” and everyone is fighting dirty.

The United States is essentially three hedge funds and an Nvidia H100 cluster in a trench coat. The economy is a casino with nukes. While economists celebrate a “soft landing,” the reality is that the US is betting the entire farm on AI. We aren’t just spending money; we are setting it on fire. Bain & Company projects the AI market to hit nearly $1 Trillion by 2027, and JPMorgan forecasts that the “Mag 7” hyperscalers alone will burn through $400 Billion in Capex in 2026.

It’s a “Strategic Bubble.” If the bet pays off, the US owns the productivity of the next century. If it fails, the dollar collapses. As Sam Altman, CEO of OpenAI, says with terrifying optimism, “The socioeconomic value of linearly increasing intelligence is super-exponential… we see no reason for exponentially increasing investment to stop."

Europe, meanwhile, has decided to sit this one out and become a Luxury Nursing Home. While America builds the Matrix, Europe is busy writing a 4,000-page white paper on the GDPR implications of the Matrix. The EU AI Act is fully online, creating a “compliance moat” so deep that only American giants can afford the lawyers to cross it. Arthur Mensch, the CEO of Mistral AI, nailed it when he said, “In Europe, we have more regulation than innovation. We need to wake up, or we will become a colony of American technology."

Then there’s China. Do not sleep on China. The Western narrative that “Sanctions killed Chinese AI” is arrogant and dangerous. Nvidia can’t sell its best chips there? Fine. Huawei’s Ascend 910C is now reportedly matching Nvidia’s A100 performance.

While the US obsesses over ChatGPT writing high school essays, China is playing a completely different game: Industrial Sovereignty. Labs like DeepSeek and Alibaba (with Qwen 2.5) are quietly releasing open-source models that beat GPT-4 on coding and math, specifically designed to be lean and efficient. They aren’t building “Her”; they are building “Skynet meets Ford.” They are embedding intelligence into the manufacturing lines of BYD and Xiaomi to automate the physical world. They are playing “Hard Tech” while the West plays “Ad Tech.”

And finally, India. The country is at the most dangerous crossroads in its history. The “Bangalore Model” is burning. For 30 years, the pitch was simple: “We have cheaper humans than you.” Wipro, Infosys, TCS thrived on labor arbitrage. That model is dead. Generative AI writes code faster, cheaper, and with fewer bugs than a Level-1 engineer.

But—and this is a big but—from the ashes, a new beast is rising. A small, violent faction of startups is building world-class IP on shoestring budgets.

- SpaceTech: Look at Agnikul Cosmos and Skyroot. They are 3D-printing rocket engines and launching satellites for a fraction of SpaceX’s cost.

- AI: Look at Sarvam AI. They aren’t trying to out-English OpenAI; they are building “Sovereign AI” for India’s 20+ languages.

As Jensen Huang, CEO of Nvidia, told Indian leaders recently:

“India used to be a country of software export. In the future, India will be a country of AI export… You cannot just be the back office anymore. You must manufacture intelligence."

The Oligopoly: The Feudal System of AI

Let’s be real. There is no “Free Market” in AI. There is a feudal system. You are a serf on digital land owned by five warlords. Economists call this the “Kill Zone”—where incumbents acquire or crush any threat before it can scale.

Nvidia is the Arms Dealer. Jensen Huang is the only man making guaranteed money in a gold rush because he’s selling shovels made of diamonds. Nvidia alone contributed to over 20% of the S&P 500’s returns recently. Jensen wasn’t subtle about it either: “We are producing something for the very first time… intelligence. We are at the beginning of a new industrial revolution." Translation: “Pay me.”

Then you have the Warlords.

Microsoft is the Landlord. They own the enterprise distribution. If you build a B2B tool, Microsoft will just add it to Teams and kill you. Satya Nadella pulled off the coup of the century by outsourcing his R&D to Sam Altman, bypassing his own internal bureaucracy.

Google is the Awakened Giant. They were sleeping, woke up, panicked, and merged Brain and DeepMind into a singular war machine. If you have a “Search Startup” or an “AI Note-taking app,” you are squatting on Google’s property. They just released NotebookLM and Sherlocked half the productivity sector overnight.

Meta is the Joker. Mark Zuckerberg is the most dangerous man in AI because he doesn’t care about making money on the model. He’s releasing open-source Llama models for free just to burn the moats of OpenAI and Google. He wants to commoditize the intelligence layer so the only value left is attention (which he owns on Instagram).

And Apple? They are the Silent Assassin. They don’t talk about “AI.” They talk about “Apple Intelligence.” They will wait for you to invent a use case, watch you struggle, and then put it in the iPhone Control Center.

The math, however, is terrifying. OpenAI is valued at ~$300B. Anthropic at ~$18B+. David Cahn from Sequoia Capital calls it the "$600 Billion Question." We need to see $600B of annual revenue to justify the capex. Right now? We are nowhere near that. We are burning cash to build a god, hoping the god pays us back before interest rates kill us.

The “Wrapper” Suicide Pact

Let’s talk about the “Thin Wrapper” startup. If your product is essentially OpenAI API + React Frontend, you are paying a “Stupidity Tax.”

Remember Jasper.ai? They were a unicorn printing money on copywriting. Then ChatGPT launched “Team” plans. Why pay a middleman when you can go to the source? It’s the “Feature, Not Product” trap. “Chat with PDF” went from a multimillion-dollar startup sector to a free button in Adobe Acrobat and Chrome in six months.

The AdTech world is facing an even weirder crisis: the “Dead Internet.” Advertisers are realizing they are paying for AI bots to click on ads written by AI bots. This is Baumol’s Cost Disease in reverse. Usually, services get more expensive over time. AI is causing the cost of cognition to plummet to zero, causing a deflationary spiral in the price of white-collar work.

As Satya Nadella put it: “The era of SaaS as we know it is coming to an end… AI becomes the central driver… The business logic is all going to these AI agents."

The Financial Bloodbath

Wall Street has seen this movie before. They are now looking at Revenue Per Employee (RPE) with a microscope.

In the legacy Salesforce era, you were doing great at $200k revenue per employee. You hired armies of sales reps. In the AI-Native era of 2025, the benchmark is $750k - $1M+. Look at Midjourney—they generated ~$200M revenue with about 11 people. That is $18M per employee.

If you have 100 employees and only $5M in ARR, you are already dead. You just haven’t fallen over yet.

Predictions for 2026 are grim. We will see a massive wave of “acqui-hires” that are really just mercy killings. Big Tech won’t buy your company for the product. They will buy it for $10M just to get your 3 best AI engineers (PhD talent is still scarce), and then they will shut down your server the next day. The VC gets their principal back (maybe), the founders get golden handcuffs at Google, and the staff gets a “Thank You” email.

Vinod Khosla wasn’t joking when he said, “I literally tell people… I’m not going to fund somebody whose goal is to reduce risk. I’d rather live in a world where I don’t mind a high probability of failure."

Future of Work: The Death of the “Feature Factory” & The End of Subscriptions

So, how do you survive? The “Feature Factory” model—where you hire 50 Product Managers to manage a backlog of minor tweaks—is over.

1. The “SaaS Depression” and the Subscription Revolt

In 2021, the average enterprise paid for 80+ SaaS subscriptions. “Digital Transformation” meant “Buying more logins.”

In 2026, CFOs are canceling everything. Nobody wants to pay $20/month per user for a tool that requires a human to operate it. We are moving from SaaS (Software as a Service) to Service-as-Software.

- Old Way: You pay $30/month for a tool, and you hire a human to use it.

- New Way: You pay the AI $100/month to do the job entirely.

- If your software doesn’t do the work, it’s just friction. The “workflow automation” tools like Zapier are being eaten by AI agents that can just navigate the web themselves.

2. The Fall of the Project Manager

The “PM-Industrial Complex” is collapsing. We used to have massive armies of Project Managers whose entire existence was to color-code Gantt charts, nag engineers for status updates, and “facilitate alignment.”

That era is over. AI generates the schedule. AI predicts the blockers. AI writes the status report before you even open the meeting.

Elon Musk brutally proved this at Twitter (now X) when he fired 80% of the staff—mostly middle management and coordinators—and the site didn’t crash; it shipped features faster. As Steve Jobs famously said years before the AI wave: “The doers are the major thinkers… the people that really create the things… are both the thinker and doer in one person."

The “Middle Manager” who coordinates people is being replaced by the “Technical Founder” who coordinates APIs. The days of being a “non-technical” Project Manager are numbered. If you can’t read the code, deploy the build, or fix the bug yourself, you aren’t a manager anymore—you’re just friction. In 2026, if you aren’t building the product, you don’t have a job.

3. Team Size: The “Single Cookie” Rule

Jeff Bezos had the “Two Pizza Rule” (teams should be small enough to be fed by two pizzas).

The new rule is the “Single Cookie Rule.”

- Klarna replaced the workload of 700 customer support agents with one AI system.

- The “One-Person Unicorn”: We are approaching the era where a single developer, augmented by a fleet of AI agents (Devin, Cursor, Claude), can build a $1 billion company. The “10x Engineer” is now the “1,000x Engineer.”

- The Reality Check: You don’t need a Head of Engineering, a QA Lead, a DevOps Lead, and a Frontend Specialist. You need one obsession-driven polymath with an oversized monitor and a Cursor subscription.

4. Digital Transformation is Dead

Consulting firms like McKinsey and Deloitte used to sell “Digital Transformation” packages for $5M that took 3 years to implement.

Today, a founder can “transform” their business in a weekend by hooking up their database to an LLM. The “consulting arbitrage” is gone. Companies don’t want a 200-page slide deck on “Synergy”; they want an agent that auto-replies to 50,000 customer emails by Tuesday.

As Amjad Masad, CEO of Replit, predicted with chilling accuracy:

“The billion-dollar company with just one employee is coming. It’s not a matter of if, but when. We are compressing the time between ‘idea’ and ‘reality’ to near zero."

The Clincher: My Moat is Fear

I saw Paul again a few months later.

The “Legal AI” startup was gone. The website now redirected to a 404 page. But Paul looked… good. Better than good. He was wearing a bespoke suit and an Apple Watch Ultra 2. We met at a private club, not a coffee shop.

“What happened?” I asked. “Did you raise a Series A?”

“I pivoted,” he said, deadpan.

“To what? Another wrapper?”

“God no,” he laughed, sipping a $25 aged scotch. “I’m a ‘Strategic AI Advisor’ now. I sit on the advisory boards of five different mid-sized legacy companies. Manufacturing, insurance, logistics. Boring stuff.”

“What do you actually do?” I asked.

He leaned in, a wicked glint in his eye. “I explain to 60-year-old board members and CXOs why they shouldn’t build their own LLMs. I sell them fear of missing out, and then I sell them ‘Consulting Services’ to do absolutely nothing.”

He held up five fingers. “Five companies. $10,000 a month retainer each. That’s $50k a month. My contract says I owe them ‘up to 10 hours’ of guidance per month. Do the math. I work 50 hours a month and make $600k a year.”

“And what is the advice?”

“I tell them: ‘Don’t build a model. You will lose. Just add a button on top of GPT-4. Focus on your data.' I just repeat the same three slides about ‘The Kill Zone’ and ‘Data Gravity’ to terrified Boomers who think Skynet is coming for their pension.”

He sat back, satisfied. “It doesn’t matter if the advice works. It doesn’t matter if they succeed. They aren’t paying for results; they are paying for permission to ignore the hype, or permission to join it. I found my moat, my friend. My moat isn’t code. My moat is the insecurity of old rich men.”

The Lesson:

Technology changes. The hustle stays the same. Don’t build a wrapper. Build a bunker. Or better yet, be the guy selling the maps to the bunker. Because Sherlock is coming, and he doesn’t need a magnifying glass to see that your “moat” is just a puddle—unless you’re the one charging admission to see the puddle.