The Rate Card Is Dead: Why Charging Rent for 'Features' Is Financial Suicide in an Outcome Economy

This is Part 2 of my series on the collapse of the traditional software industry. In Part 1, How “Vibecoding” and The Outcome Economy Are Killing the SaaS Dinosaurs, I explained how AI is making software production free. Today, let’s talk about why your pricing model is about to bankrupt you.

—

If you read the first post, you know we are witnessing the extinction event of the “SaaS Dinosaur”—those bloated software companies that charge you rent to move data from Column A to Column B.

But there is a second asteroid hitting the industry, and this one isn’t about code. It’s about money. Specifically, the collective hallucination known as Seat-Based Pricing.

“Software is eating the world.” — Marc Andreessen (2011)

Marc was right. But in 2025, he forgot to mention that the software would eventually eat the business model that paid for it.

I recently sat in on a Zoom call that perfectly encapsulates the absolute delusion of the current software industry.

On one side was an “Enterprise Account Director” from a massive, publicly traded AdTech company—let’s call the company OptiMax. The rep, let’s call him Jason, had hair so perfect it looked rendered in Unreal Engine 5. He was wearing a Patagonia fleece vest that had clearly never encountered nature.

On the other side was the CTO of a fast-growing D2C e-commerce brand. She looked tired. She looked like someone who actually ships code.

Jason was trying to close a renewal for their Creative Management Platform. He flashed a blindingly white smile and said, “So, to support your hyper-growth next year, we recommend bumping you up to the ‘Enterprise Synergy’ tier. That unlocks 40 seats for your design team, unlimited folder nesting, and our new ‘Collaboration Lounge’.”

The CTO rubbed her temples. You could physically see her soul leaving her body to go to a happier place.

“Jason,” she said. “We don’t have 40 designers anymore. We have two. And we have an AI agent swarm running on a local server that generates 5,000 banner variations a week, tests them on Meta, and kills the losers automatically.”

Jason blinked. His brain, trained on a decade of “Land and Expand” playbooks, short-circuited. “Okay… well, that sounds… disruptive. But the Enterprise tier requires a minimum of 20 seats to unlock the API rate limits. Can you… can you assign seats to the agents? Like, create email addresses for the Python scripts?”

The CTO stared at him. The silence was so loud you could hear Jason’s career evaporating.

“You want me,” she said slowly, “to create fake email addresses for a script named banner_bot_v4, just so you can charge me $150 a month for it to not log in, not look at your beautiful dashboard, and not attend your webinar on ‘The Future of Creativity’?”

“Well,” Jason stammered, mentally calculating the hit to his Q4 commission. “How else are we supposed to bill you? It’s industry standard.”

The CTO didn’t renew. She hired a freelancer to build a lightweight interface on top of the Midjourney API and a headless CMS. Jason lost the deal. OptiMax lost the client.

This is the state of B2B SaaS in 2025. We are trying to sell gym memberships to robots that don’t have bodies.

The Seat-Based Ponzi Scheme (Zero Marginal Cost)

For the last fifteen years, the “Per User/Per Month” subscription model has been the golden calf of the tech industry. Venture Capitalists loved it. It was predictable. It relied on the economic concept of Zero Marginal Cost. Once the software is built, it costs the vendor $0.00 to add another user, so that $50/month fee is pure profit margin.

“Show me the incentive and I will show you the outcome.” — Charlie Munger

Munger’s wisdom explains why we are here. The model worked because humans were the bottleneck. If you wanted to scale your ad campaigns, you had to hire more traffickers, designers, and copywriters. If you hired more people, you bought more seats. Revenue grew linearly with headcount.

But we have entered the age of AI. The goal of every competent company today is to reduce headcount while increasing output.

If your pricing model relies on my headcount growing, you are taking a short position on technology. You are betting that I will fail to automate.

If I successfully replace my 20-person ad ops team with one really smart LLM agent, your revenue drops from $3,000/month to $150/month. This creates a perverse incentive structure: You are financially incentivized to keep my business inefficient.

That is not a partnership. That is a hostage situation.

The Great Rate Card Scam (Price Discrimination)

Before we talk about the future, let’s look at the “Menu of Confusion” that most SaaS companies are still using today. Economists call this Price Discrimination: the art of charging different customers different prices for the exact same product, based on their willingness to pay rather than the cost to serve.

It usually looks like this:

- The “Starter” Tier ($0 - $20): This exists only to mock you. It allows you to create a project, but if you want to export it, save it, or actually use it, a popup appears telling you to upgrade. It is software as a ransom note.

- The “Pro” Tier ($50 - $100) - ⭐️ RECOMMENDED: This is the trap. They highlight it in blue. They put a “Most Popular” badge on it. It includes 5 seats you don’t need, but it holds the one feature you do need (like API access) hostage.

- The “Enterprise” Tier (Contact Sales): “Contact Sales” is Latin for “How much money do you have?” This tier is identical to the Pro tier, except it includes Single Sign-On (SSO).

“Enterprise software pricing is about extracting the maximum amount of money from the customer without them laughing in your face.” — Jason Fried (CEO, Basecamp)

This model relies on Feature Gating. The value isn’t in using the product; the value is in unlocking the gate.

But in an AI world, this collapses. If I am using an AI Agent to interact with your software via API, I don’t care about your UI features. I don’t care about your “Dark Mode.” I don’t care about your “Collaboration Lounge.” I just want the data in and out.

The “Long Rate Card” becomes irrelevant when the user is a Python script. A Python script doesn’t have an ego, and it doesn’t need a personalized dashboard.

The Pivot: Usage-Based Pricing (The Physics of Value)

The companies that will survive are the ones shifting to Usage-Based Pricing (UBP).

This isn’t just “Pay As You Go.” It is a sophisticated metering of value consumption. It shifts the metric from “Access” (Login) to “Throughput” (Work Done).

“Your margin is my opportunity.” — Jeff Bezos (Founder, Amazon)

Bezos understood this before anyone. AWS didn’t charge you for “Server Access.” They charged you for the seconds your server ran. This aligned incentives perfectly: if you grew, Amazon grew.

How It Actually Works: Monitoring & Measurement

In a UBP model, the software vendor installs a digital “utility meter” inside the codebase.

- Metering Events: Every time the software performs a distinct action (e.g., an image is resized, a query is run, a fraud check is passed), a “metering event” is fired to the billing engine.

- Aggregation: These events are aggregated. You don’t see 10,000 line items; you see “10,000 units consumed.”

Real World Examples

1. The AI Infrastructure Model (OpenAI / Anthropic)

- The Metric: Tokens.

- Why: They don’t charge you for “having an API key.” They charge for the complexity of the thought. An essay costs more than a tweet. This is pure physics-based pricing. If you stop thinking, you stop paying.

2. The New Age AdTech Model (The “Vibecoded” Ad Server)

- Old Way: Monthly fee based on “Estimated Impressions” tiers. (Guesswork).

- New Way (UBP): Rendered Creatives. The system counts exactly how many times the AI generated a unique banner ad variation. If the client’s campaign is paused, their bill drops to near zero. If they scale for Black Friday, the bill spikes, but they don’t mind because they are printing money.

The vendor becomes a partner in efficiency, not a landlord of shelfware.

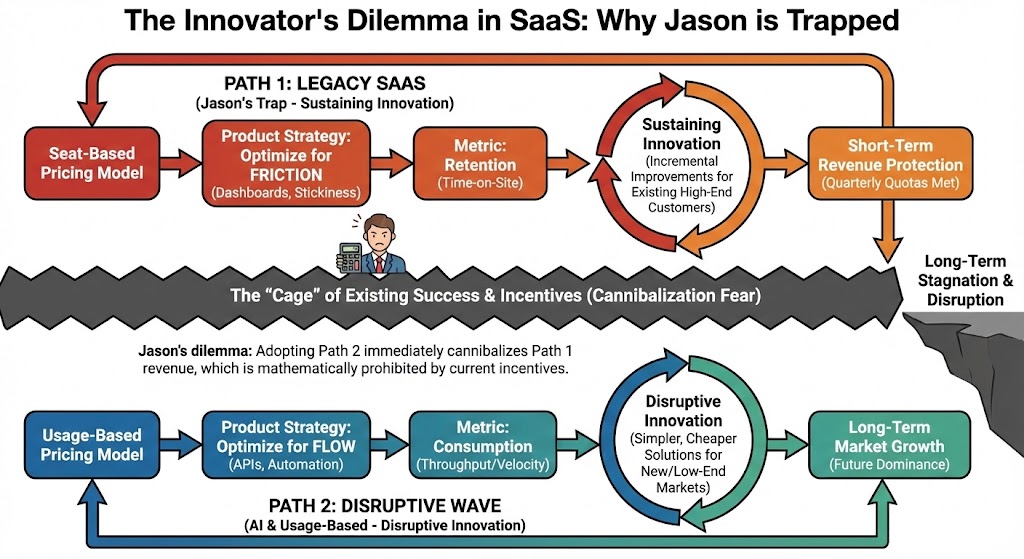

The Innovator’s Dilemma: Why Jason Is Mathematically Prohibited From Changing

Here is where the sarcasm needs to take a backseat to cold, hard economic theory. The legacy SaaS companies—the Salesforces, the Adobes, the OptiMaxes—are in serious trouble. And it’s not because they are stupid. It is because they are trapped in what Clayton Christensen famously called The Innovator’s Dilemma.

“The reason why it is so difficult for existing firms to capitalize on disruptive innovations is that their processes and their business model that make them good at the existing business actually make them bad at competing for the disruption.” — Clayton Christensen (The Innovator’s Dilemma)

For Jason at OptiMax, the problem isn’t just outdated pricing; it is that his Pricing Model dictates his Product Strategy. This is a financial version of Conway’s Law: systems are designed to mirror the communication structures of the organization.

In SaaS, your revenue model designs your roadmap. Let’s break down the two opposing physics at play here.

1. The Seat-Based Trap: Optimizing for Friction (SaaS 1.0)

When you charge per seat, your North Star metric is Retention. To keep a human paying $100/month, that human must feel “locked in.”

- The Incentive: The Product Manager is incentivized to build “Stickiness.”

- The Feature Set: Complex dashboards, social feeds, gamification, and proprietary file formats.

- The Hidden Goal: Maximize Time-on-Site. If the user finishes their work in 3 seconds and leaves, they might question why they pay for the subscription. So, the software subtly adds friction to justify its existence.

2. The Usage-Based Future: Optimizing for Flow (SaaS 2.0)

When you charge for usage (compute/throughput), your North Star metric is Consumption. To keep a machine paying $0.05/transaction, that machine must encounter zero resistance.

- The Incentive: The Product Manager is incentivized to build “Velocity.”

- The Feature Set: High-performance APIs, Webhooks, SDKs, and Headless architectures.

- The Hidden Goal: Minimize Time-to-Outcome. If the task takes 3 seconds, you optimize it to 0.3 seconds so the client can run it 10,000 times more.

The “Cannibalization” Death Spiral

This brings us to the specific mechanism that kills the dinosaur. I call it the Revenue Cannibalization Loop. Legacy companies cannot switch to usage pricing because the math doesn’t work in reverse. They are addicted to the “inefficiency margin.”

Imagine you are the CEO of OptiMax. You charge $100/seat.

Your engineering team proposes a new “AI Auto-Resize” feature that automatically formats banners for Instagram, TikTok, and LinkedIn.

- The Efficiency: It saves the client 100 hours a week.

- The Economics: If you ship this feature, your client fires the 5 junior designers whose only job was resizing banners.

- The Consequence: If they fire those designers, they cancel 5 seats ($500/month revenue loss).

This is the definition of a Perverse Incentive.

- If you innovate (automate work): You lose revenue immediately.

- If you stagnate (keep manual work): You lose the customer eventually to a disruptor.

Jason chooses stagnation every time. He has a quarterly quota to hit. He cannot sell a feature that shrinks his deal size.

The Future: The “Outcome Economy” (Next 5 Years)

So, where does this go?

In the short term (1-3 years), we will see a messy transition to Hybrid Pricing. Companies will charge a small platform fee plus a “consumption tax” on AI tokens. It’s clunky, but it stops the bleeding.

But the real endgame (5 years out) is Outcome-Based Pricing. This is where “Agency-as-a-Service” becomes real. This solves the Principal-Agent Problem. In the old model, the software (Agent) didn’t care if the user (Principal) succeeded, as long as they paid the bill. In the new model, incentives are aligned.

“We are moving from a world of ‘software tools’ to a world of ‘digital employees’. You don’t buy a tool; you hire an agent.” — Vinod Khosla (Khosla Ventures)

If I hire an AI Media Buyer, I shouldn’t pay for the software or the usage. I should pay for the Result.

- Seat Model (Old): Pay a DSP (Demand Side Platform) a monthly fee + % of spend to access the dashboard. (You take the risk).

- Usage Model (Current): Pay $0.01 per thousand bid requests processed. (Shared risk).

- Outcome Model (Future): Pay a % of the ROAS Lift or a fixed fee per Converted Customer. (Vendor takes the risk).

In an outcome model, the software vendor is incentivized to be ruthlessly efficient. If their internal AI agent wastes 1,000 tokens trying to find a customer, they eat that cost, not me. This drives massive innovation in efficiency.

The vendor becomes a partner. They aren’t selling you a shovel; they are selling you a hole. And if the hole isn’t dug, they don’t get paid.

The Road Ahead

We are going to see a massacre of “Middle-Tier” SaaS companies. The ones who refuse to let go of the subscription blanket will slowly suffocate. Their product roadmaps will become increasingly hostile to automation, trying to force humans to click buttons just to justify the monthly invoice.

They will become “Zombie Unicorns”—huge valuations, massive revenue, but functionally dead because they cannot adopt the technology that would save them.

“Only the paranoid survive.” — Andy Grove (Former CEO, Intel)

Meanwhile, the Vibecoders are coming.

They are building lightweight, usage-based tools that solve specific problems for fractions of a penny. They don’t have sales teams named Jason. They don’t have minimum seat counts. They just have an API key and a promise: We only make money when you do.

Let’s go back to that Zoom call.

After the CTO hung up on Jason, she didn’t just build a creative tool. She set up a usage-based billing account with OpenAI and an image generation API. She connected a few webhooks.

Her total cost for the month was $42.18.

The output was equivalent to three full-time designers.

Somewhere in a glass office in Manhattan, Jason is updating his sales forecast. He’s marking that deal as “Stalled / Nurture.” He thinks he just needs to send the CTO a better case study. He thinks if he just explains the value of the “Enterprise Synergy Dashboard” one more time, she will cave.

Jason doesn’t know it yet, but he’s selling buggy whips to a woman driving a Tesla. And the meter is running.